Digital Remodel

Welcome to renovated digital banking.

Your tiny home for Online and Mobile Banking.

Our Online Banking and Mobile Banking are updated with the look and feel that will make your digital experience feel as handcrafted as if you were walking into your neighborhood branch. Easier to navigate, and more customizable than your favorite work station. We think you’re going to like it.

ENHANCEMENT: 6/9/22

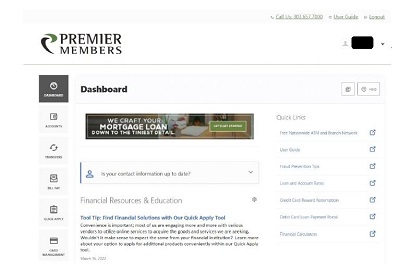

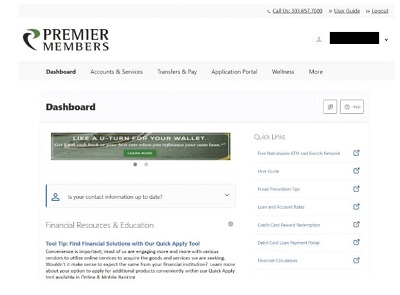

Updated Desktop and Mobile Look

Members will notice a new look to Desktop Online Banking. The navigation will move from the left side of the screen to the top of the screen:

|

Old Navigation

|

|

All widgets are still available to view, they will be located in dropdown menu instead of widget icons. There will also be changes coming to the Mobile Application later this month. More information on that can be found here.

ENHANCEMENT: 3/21/22

Card Alerts & Fraud Protection

To ensure we do our part in preventing you from debit and credit card fraud, we will be rolling out a new way to communicate with you to deter fraud on your accounts. We will start to notify you of suspicious card activity via text message, helping you stay on top of your account activity in real-time. You’re automatically enrolled, so we will contact you when we see something suspicious via text message. Simply follow the instructions provided at the time you receive a text alert in order to take swift action and avoid future unauthorized use of your cards. Please confirm your contact information on file is accurate and make any alterations as needed to your mobile number to ensure you can benefit from this service going forward. You can update this information by phone, in-person at your local branch, or conveniently through Online or Mobile Banking. Those who do not have a cell phone or one listed as “mobile” will continue to receive phone calls from our fraud monitoring service as is the process today.

To learn more about this enhancement, please review the below FAQs.

How do I enroll?

You’re automatically enrolled, so we will contact you when we see something suspicious via text message. Wish to unenroll in this service? Not a problem. Just follow the prompts to opt-out of the service, but please continue to do your part to consistently monitor your transaction activity through Online or Mobile Banking. You will continue to receive phone calls regarding suspicious card activity.

What card types will this service work for?

The new fraud text alerts will work for any and all debit and credit cards you have with PMCU.

How long do I have to respond to the text and what happens to my card in the meantime?

Members will have 5 minutes to respond to the message prior to any impact on their card. Until that 5-minute threshold is reached, your card will remain active for additional use and the transaction will remain in pending status. If no response is received within the 5-minute threshold, the transaction will be assumed as unauthorized and your card will be frozen.

What details will be present in the text so I can quickly validate if that transaction is genuine?

The original text you receive will include the following details to best assist you in confirming legitimacy of the transaction: the date, the last four digits of the card used, the amount, and the vendor.

I don't have a cellphone, so how will I be notified of unauthorized card usage?

Members who do not have a cellphone nor have it on file with PMCU will continue to receive calls from our fraud monitoring service as they do today.

What other account alerts are available to me?

You can review all available alerts by signing into your account via Online or Mobile Banking and clicking on the “More” button followed by “Alerts”.

ENHANCEMENT: 12/31/21

Bill Pay Updates

Members enrolled in Bill Pay within Online & Mobile Banking will no longer be able to utilize a savings account type for bill payments. These account types include:

- Primary savings account

- Alternate savings account

- Primary business savings account

Members will still be able to use their checking and/or Money Market accounts for bill payments as they do currently. Recurring payments scheduled to pay from one of these restricted account types will fail and will not be processed to the recipient, and members will no longer see these account types as an option to pay from when initiating a one-time bill payment.

To best support you with this change, we recommend you take the below action(s) as they may specifically apply to you prior to December 31, 2021. If you have questions of your own, give us a call at 303.657.7000.

- If you have a default ‘Pay From’ account setup within Bill Pay for any and all of your payees, please change this to a proper funding account (i.e. a checking and/or Money Market account). Members can do this by navigating to the specific payee in question from the ‘Bill Pay Dashboard’, clicking on the ‘Manage’ tab, and scrolling down to the ‘Sender Information’ space. Simply click the ‘pencil’ icon adjacent and update the payment account as instructed.

- If you have a recurring bill payment setup to debit one of these soon-to-be restricted account types, you will need to cancel the recurring bill payment in place and recreate it with a proper funding account. Members can do this by navigating to the ‘Scheduled’ tab within Bill Pay and then scrolling down to your upcoming recurring payment. Click on the ‘trash can’ icon adjacent and be certain to select the ‘Cancel All Automatic Payments’ option. To create the new recurring payment, simply navigate back to the payee from your ‘Bill Pay Dashboard’ and initiate a payment with a proper funding account, payment amount, start date, and payment frequency option.

- If you do not currently own a checking and/or Money Market account with PMCU, you can apply for either or both products quickly and conveniently through the Quick Apply tool in Online & Mobile Banking. If products are not opened prior to the December 31, 2021 cutoff date, members will see an error message when attempting to utilize the Bill Pay tool as they will not be eligible for this service at that time.

ENHANCEMENT: 9/27/21

Bill Pay Updates

We are implementing a change to our Bill Pay tool within Online and Mobile Banking crafted to more closely align with how you see checks clear your account normally. For all bill payments sent via check from this date onward, checks will clear your account once they are received by the recipient and processed by their financial institution. No electronic debit of your account will process in coordination with these payments, and much like a normal check our members write, you will now possess the confirmation that they were received and paid within the transaction history of your debited account.

To better understand what this change means for you, please review the below FAQs. If you have questions of your own, give us a call at 303.657.7000.

Will this change impact any payments that are sent electronically through Bill Pay?

Nope! There will be no impact on any bill payments sent electronically. This change will only impact those payments that are sent via standard check.

Do I need to update my payees that are set to receive bill payments via standard check?

That’s another nope! No changes are necessary to your current payees that are setup and default to receive their payments via standard check.

How do I know if a payment is being sent electronically or via standard check in Bill Pay?

Members can confirm the method of payment for each payee by clicking on the payee in question from the Bill Pay Dashboard. Simply review the default Delivery Method to confirm how that payment is being delivered to the end recipient.

What happens to recurring payments I have in place that are sent via standard check?

Please don’t worry as previously scheduled and recurring payments sent via standard check will stay in place.

Will bill payment check images still be available for viewing?

Most certainly! While previously paid check items will still be viewable within your Bill Pay History, checks sent on 9/27/2021 or later that clear your account will now be available within the transaction history of the account you selected for funding.

What if I don’t see the check clear my funding account? Can I still put a stop payment on it?

If a check you send via Bill Pay has not cleared your account within two weeks, simply contact us to look into it further. This may be an indication that the check has not been processed by the financial institution of the recipient. A stop payment can still be placed on the check internally, and the good news is that we don’t have to wait another 2-3 business days to get your funds returned to your account as was the process before.

Why am I unable to see any check images for cleared checks on my account?

If you are having issues seeing any check images within online banking, whether you write them or they are sent via Bill Pay, please contact us so we can best assist you. We will be able to diagnose the specific issue you are experiencing, and do our part to remedy the situation as soon as possible.

ENHANCEMENT:

Your FICO® score is now available!

Accessing your credit score is now as easy as logging into your digital banking. Located in your widget options menu, please find the FICO Score widget under the available section. Once added, you can add it to your favorites!

You’ll find:

- Your FICO® score (updated quarterly)

- The date your FICO® score was pulled

- Top 2 factors that are affecting your score

It’s updated quarterly, and you don’t have to worry about any credit impact from it. Most importantly, it’s free. It really was a no-brainer to add it to your digital banking experience, and we hope it helps you better track your finances. To learn more about FICO® scores visit ficoscore.com/info/.

Here is some important information for you to know about:

Mobile users will need to update or download the new apps on Google Play (must uninstall old app and download new app) or the Apple App (update or uninstall and download new app) stores. The new apps are named Premier Member Credit Union (formerly Premier Members Mobile).

- To see the features of Mobile Banking, visit Mobile Banking Applications; or read all about Mobile Banking in the User Guide..

- To see the features of Online Banking, visit Online Banking; or read all about Online Banking in the Users Guide.

Browser Support

- We do not recommend using Internet Explorer as your web browser when accessing Online Banking. In general, PMCU online banking operates on the last two versions of supported browsers. This ensures PMCU online banking is up to date with the latest browser releases and also ensures browsers are as secure as possible. The following browsers are supported:

- Google Chrome: Latest 2 versions (87.x, 88.x)

- Firefox: Latest 2 versions (83.x, 84.x)

- Microsoft Edge: Latest 2 versions (87.x, 88.x)

- Safari: Last 2 major versions or 1 major version if over 1 year old (El Capitan 11.x, Sierra 12.x, High Sierra 13.x, Mojave/Big Sur 14.x)

- Chrome for Android: Last 2 major versions (87.x, 88.x)

- Mobile Safari for IOS: Last 2 major versions (13.x, 14.x)

Browser Support Alert

The browser support alert (popup that automatically displays if the end user is not using a known supported browser) has been configured to accommodate a broader browser version spectrum. It does not popup and alert end users based on the official supported browsers list above.

Device Support

PMCU online banking operates on Windows and Apple OS X computing platforms as well as Android and IOS mobile platforms

- Windows: versions that are still supported by Microsoft and support a browser listed above

- OSX: versions that are still supported by Apple and support a browser listed above

- Android: v6.0 and above

- IOS: the last 2 major releases (13.x, 14.x)

Minors 12 and under

- Parents should be aware that that data is being collected as if they were an adult. Minors 12 years of age and under will no longer be able to log into online banking