Few people would say

there’s an art to banking.

Money in. Money out. A fee or two along the way.

Real returns on real-world balances

Meet your money market and earn 5.00%* on your first $2,000 with no minimum balance.

Reverse Tiered Money Market Earnings Calculator

| Tiers | APY |

|---|---|

| {{ tier.distributed | dollar }} | {{ tier.rate | percent }} |

This calculator is for illustrative purposes only and does not reflect the actual results of any specific deposit amount.

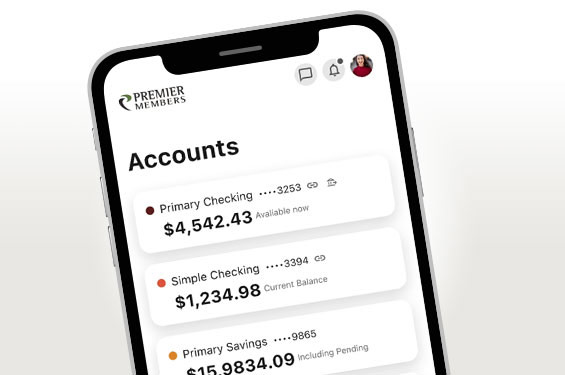

Banking on the go

Locate ATMs, mobile check deposits, transfer between accounts, schedule bills via billpay, block a lost/stolen card, and much more.

We care about what you care about.

We call it the six pillars of being Premier.

Gives

Youth

Sustainability

Service

Innovation